Blog | 22 Jul 2024

Chloe Parkins

Senior Economist, Tourism Economics

This week, the world’s eyes will turn to Paris for what is billed to be the largest event ever organised across France. The 2024 Summer Olympics will provide an important opportunity for the host nation, France, as the events attract tourists from both domestic and overseas markets.

As part of the bid to host the Olympics, the French Center for Sports Law and Economics conducted an economic impact study on behalf of France in 2016. This study quantified the impact that the 2024 Olympics may generate at up to €10.7 billion and up to 247,000 jobs. Of the €10.7 billion, approximately €1.4-€3.5 billion (13-33%) is attributed to tourism-related economic impact. These figures are welcome, yet should be interpreted with caution as much has changed since 2016, most notably the pandemic and inflation.

Impact of the Olympics

Our expectations for the Paris Olympics were informed by the same visitor and spending variables as the London Olympics—though we compared our 2024 forecast to 2019 rather than using a multi-year approach due to COVID-19 disruptions. The overall impact of the games will be centered in the Paris city and St. Denis department where the Stade de France is located. These effects largely focus on the international side of event-driven demand. However, domestic demand remains essential as many domestic tourists will partake in Olympic-related activities, further elevating the overall impact.

With the event on the immediate horizon, high-frequency data is beginning to illuminate the Olympics’ actual impact on hotels and tourist activity. Hotel prices have, as expected, been priced at a premium during the event and have been further elevated by an increase in the tourist tax. The increase will result in tourists paying nearly 200% more tourist tax per night, according to accommodation type. The tax now ranges from a relatively affordable €2.60 to €14.95 for luxury accommodation per night. Lighthouse highlights that average hotel prices among three to five-star hotels have risen by 41-64% above the yearly average during the event. Expected hotel occupancy rates were slow to increase at the start of this year, likely due to the inflated prices. But the latest data from STR shows occupancy rates are up both in Paris and across the Île-de-France region as a whole as of the end of June.

The slower-than-expected initial uptake of rooms likely contributed to some discounting in room rates reported over the last month and highlights affordability as a key concern for those wanting to attend the games. However, the recent pick up in occupancy across the Île-de-France region is an encouraging sign from a value perspective. This indicates that tourism revenue will likely be a bit more widespread extending to other less-visited towns and cities outside of the capital. A key side-effect of this is that tourists will explore destinations they may not have otherwise stayed at and will encourage future trips outside of Paris.

With benefits, come drawbacks. Closures around the city will reduce traffic flows, impacting local businesses reliant on normal, footfall tourist volumes. Additionally, event-related increases in the tourism tax could compress travel budgets resulting in less spending at tourist attractions and retail establishments. Increased disruptions and higher costs have deterred travel leading up to the games starting. STR data shows that Paris hotel bookings are slightly down on the year overall for around a month prior and both Air France and Delta Airlines have reported disappointing bookings numbers outside of event-goers.

We expect the early-summer lull in arrivals to France and Paris to be temporary as some travellers try to avoid the crowds. That said, France is still an attractive destination for various source markets. Tourists who cannot afford to visit during the Summer Olympics will likely come at a later date or they may choose to travel while the Paralympic Games are underway at the end of August through the start of September. This is supported by STR data which show that hotel bookings remain elevated on the year out to the middle of September so far.

What does this mean for France as a whole in 2024? The country is set to remain the largest European destination in terms of international arrivals, reaching 101 million this year (up from 98.2 million in 2023) based on our latest forecasts. A stronger relative performance is anticipated for Paris as it enjoys a larger direct impact from the event with international arrivals into Paris rising to 14% above 2019 levels and France just 11%.

The Olympics’ impact on spending will also differ between France and Paris—one reason being the higher relative cost of staying in Paris compared to nearby, commutable destinations such as Chartres and Reims.

Hover over the bar to check the value

Source Market Medal Board: Who’s Leading?

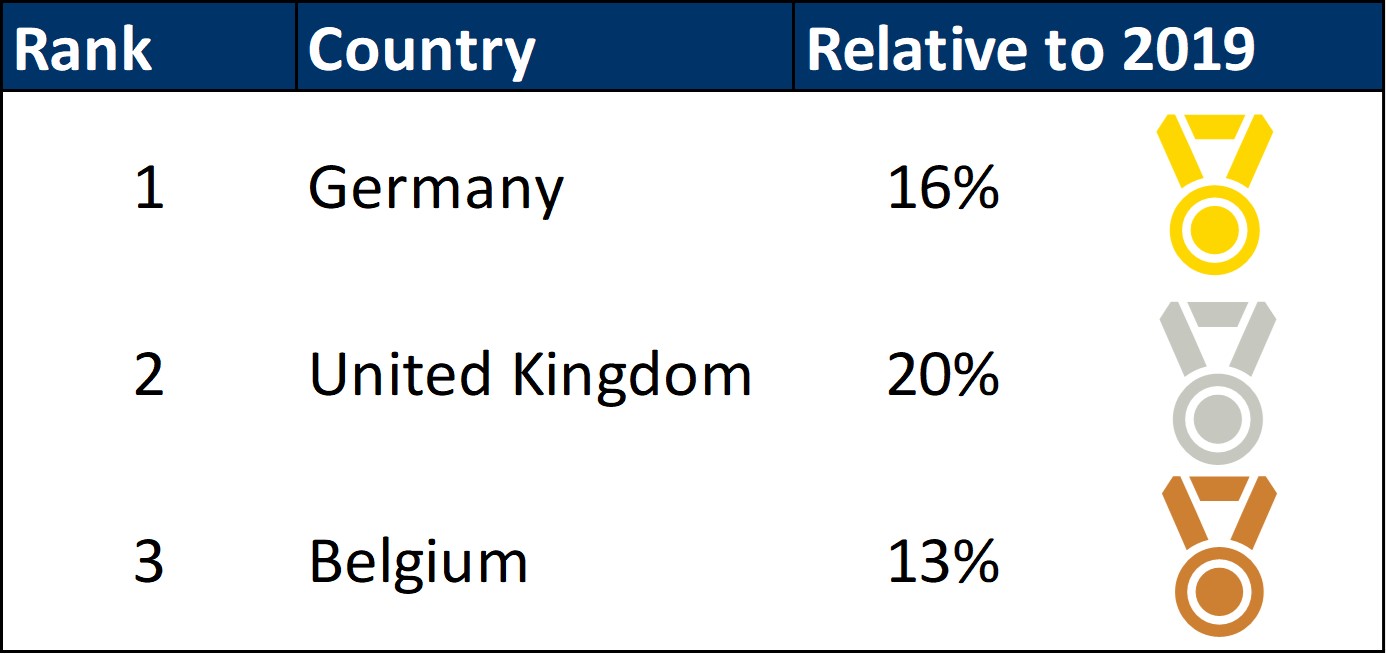

Tourists from Germany, the United Kingdom and Belgium take the gold, silver and bronze medals for the largest and most recovered source markets for France this year. A rise in intra-regional travel across Europe is expected for the 2024 Games as tourists have a range of transport options available, such as road, rail and air. For most, travel costs will be relatively cheaper than flying long-haul to watch future Olympic Games—a considerable motivator for European spectators.

International arrivals recovery to France from top 3 largest source markets, 2024

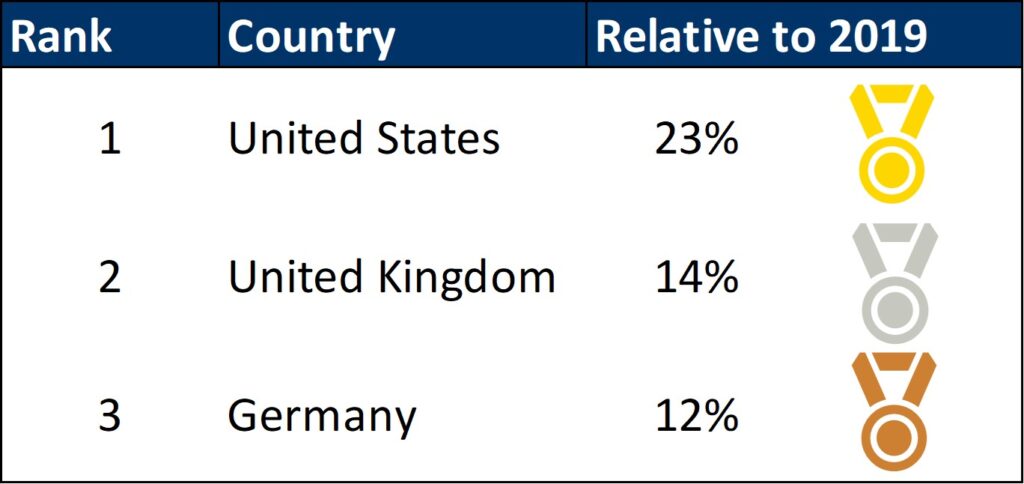

The most impactful source markets at a country level will not necessarily be the same at a city level. Paris is set to see a continuous flow of US tourists, with arrivals set to be 23% above 2019 levels this year. The UK and Germany still make the podium in 2024, but in contrast to the US, city-level recovery will be slightly less than at the country level.

International arrivals recovery to Paris from top 3 largest source markets, 2024

However, some demand from some smaller source markets such as Brazil are set to see some uplift from the event. Notably, arrivals from Brazil to France as a whole are still expected to be below pre-pandemic levels this year, though, the opposite is the case for Paris. Some differences are due to stronger demand for the games, increased flight connections and strong travel sentiment among wealthy tourists in Brazil whose destination of choice would more than likely be Paris.

The impact of the Olympic games is hoped to extend far beyond the summer of 2024. On the sustainability and legacy of the games, the 2024 Olympic organising committee outlined an ambitious and far-reaching set of objectives—more comprehensive than those of previous games such as London 2012. The committee promises a carbon-neutral event and strives toward a positive impact on the climate, not limited to the major 1.4 billion euro clean-up operation of the Seine River. There are also plans to move 6,000 new residents into the neighbourhood formerly used as the Athlete’s Village. These environmental and societal efforts, if successful and long-lasting, may help reduce the strain on destinations that host the events in future years, but also support the domestic residents within these tourist hot spots and help to preserve and enhance France’s natural resources.

The analysis forecasts in this blog are backed by our Global City Travel service, offering and comparable inbound and outbound travel intelligence for over 300 cities worldwide. To a free trial, please click here.

To read more about the economics of Olympics, please click here.

Subscribe to our newsletter

Economics is everywhere. From central bank’s rate cut to impacts of Olympics, our passion for economics gives us a unique view of the world, as well as its challenges and opportunities. For over 40 years, we provided timely economic and business insights to our clients, helping them grasp the impact of key events on their operations and planning.

Subscribe to our newsletter to get our insights straight to your inbox. Additionally, you can check ‘Talk to us’ box to have our team contact you about a free trial of our services and how we can support you.

Author

Chloe Parkins

Senior Economist, Tourism Economics

+44 (0) 203 910 8017

Chloe is a Senior Economist with Tourism Economics, specialising in European tourism forecast services. On top of forecasting, she takes a key role in European consultancy work including regular outputs for the ETC and STR. She previously worked on both the industry and macro services within Oxford Economics for seven years where she developed her skills in forecasting, modelling, data visualisation and bespoke consulting work.

You may be interested in

Post

Europe: Among major southern cities, Madrid looks strongest

We are cautiously optimistic about the medium-term outlook for Europe’s cities as a whole, but less sanguine about southern European cities than most others. They have tended to underperform in the past and will probably do so in the future. Madrid, the largest, has the strongest growth prospects of the larger cities.

Find Out More

Post

Eurozone: Nowcasts show a cold start to 2024, but warming later

Our suite of nowcasting models corroborates our tepid near-term expectations for the hibernating eurozone economy, indicating Q1 growth will come in at 0.1% q/q. This is a touch below our 0.2% q/q baseline forecast, though the spread of results across our models plus mixed signals from latest data highlight the uncertainty around the immediate growth outlook.

Find Out More

Post

France: What surging apprentice figures mean

Generous subsidies to apprenticeships introduced in 2020 have pushed up French employment numbers and will continue to if the policy is maintained. The key is to improve the efficiency of the scheme, which would enhance France’s public debt sustainability and its growth potential. Simply cutting the current subsidies for budgetary reasons would lower output levels without improving the country’s long-term debt dynamics.

Find Out More