Nobody has yet brought perovskite-silicon tandem solar technology to scale. This is not for lack of trying; the technology has benefitted from years of research, mountains of funding and even more yards of press, but so far, nobody has begun producing at market scale.

In the 2024 International Technology Roadmap for Photovoltaics, the researchers and experts at VDMA predicted that tandem modules would be in mass production in 2027. David Ward agrees. In our conversation, he lays out Oxford PV’s timeline for producing perovskite-silicon tandem products at scale.

The company, which holds a strong portfolio of patents around perovskite and tandem technology dating back to 2011, said that the first sector to see real progress in perovskite modules will be niche and specialised applications – aerospace, outer space and other “places where you’ve got a really high cost-base for gallium arsenide cells right now,” Ward said.

“We expect meaningful scale within that marketplace in 2025,” he said. “We’re strategically valuable [in the specialised market], not just on an LCOE-basis like at utility-scale. You can deploy for longer; you can make more aeroplanes because it’s cheaper, you can crash them more often because it’s cheaper.”

He said that Oxford PV would then look to enter the residential market in 2026, “and then during 2026 and into 2027 is when we’ll have the high volume manufacturing up and running (we hope) and that’s our main entry into utility-scale.”

Ward tells PV Tech Premium that Oxford PV is “further ahead” than the competition when it comes to tandem technology: “Lots of people are still doing one centimetre [products], you definitely see people doing the M6 cell…they’re still good, they’re very well organised companies, but they’re also a bit behind ‘this’”.

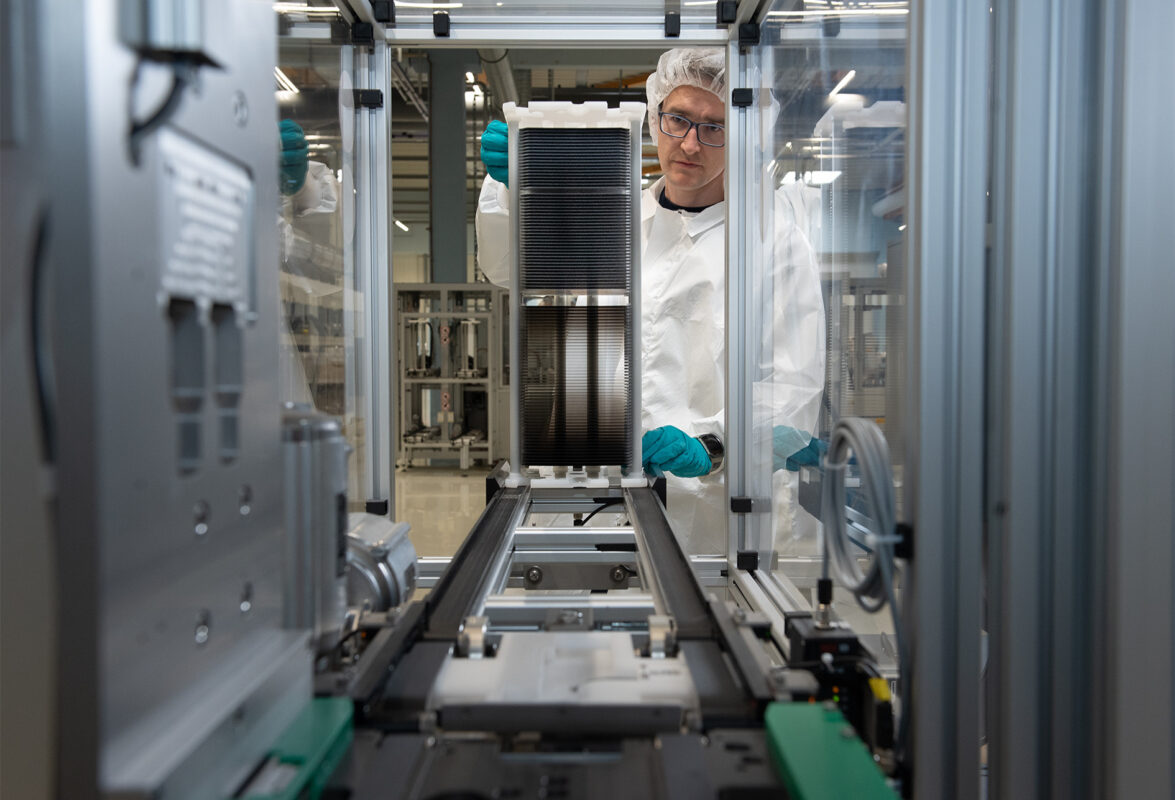

The Brandenburg factory

The “this” to which Ward refers was Oxford PV’s current world record silicon-tandem module, which sat fairly inconspicuously at the trade show stall where he spoke with us.

It was produced at the company’s facility in Brandenburg, Germany, where it boasts the “world’s first volume manufacturing line” for silicon-perovskite tandem cells. “Every day that goes by in Brandenburg, we learn something new,” Ward says. “Literally every day we do something, or we learn something, that someone else is going to spend time doing. The more times you do something, the more you learn and the better you get.”

The facility was completed in 2021, and Ward says that it serves as a modelling facility for truly large-scale manufacturing; “Everything we do in Brandenburg is the process that will be done at high volume; we don’t have to invent anything new. We need some bigger machines,” he laughs, “that do things to lower unit cost because of the volume, but that’s all available today and it’s available around the world, from the West and the East.”

The world record efficiency module will take “a couple of years” to go from a world record to “mainline production”, he says. But once it’s there, it’s there to stay: “Once a 27% module is available, nobody buys 24% or 23%. It doesn’t make economic sense; however much this might be a more expensive [cell] architecture because it has more material in it, the value you get from that system is clear. People will be more than happy to pay more on a per-unit basis, because on a kilowatt-hour basis, on the output side, they get vast savings of 20-30%.”

Degradation – ‘We’re comfortable where we are’

As mentioned above, the most obvious reason that no perovskite solar modules are being made in serious numbers is the substance’s degradation. It is volatile – very reactive to moisture, heat, oxygen and light to an extent that has, so far, made it unsuitable for real-world deployments.

Ward said that Oxford PV is “comfortable” with its position regarding the degradation issue: “It matches the customer requirements, they’re really happy to take the product in the current form.”

The customers in question are utility-scale companies who are piloting Oxford PV’s tandem modules at their sites. “Our first shipments are going out in a couple of months,” Ward says. “They really want to get access to the technology and the modules in the real world to go and test them, because what they want is access to the gigawatt scale of this stuff.”

But the GW scale still isn’t here, and Ward’s confidence and the existence of pilot customers was still not a firm answer to the degradation concerns that have always plagued perovskite.

He did, however, elaborate on the company’s philosophical approach: “Is it a 30 or 40-year product today? Absolutely not. But we would never say it was.

“Chris [Case, CTO of Oxford PV] has always believed that we should say nothing publicly which isn’t certified. I don’t care what other people are saying. What we care about is what we can do today that we can point at as independently verifiable. Until we can prove it, we could say anything we like, and it doesn’t really matter.”

Moreover, he said that perovskite was like a tide that would certainly come into its moment in the industry: “The majority of the world has moved on from the idea that it’s unclear whether perovskites will ever be stable enough for commercial applications. If you still think that today, then there are a lot of big companies with smart people spending a lot of money on a wild goose chase.”

In the last two months, for example, Chinese solar manufacturing giants LONGI and JinkoSolar have both announced silicon-perovskite tandem products. JinkoSolar posted a 33.24% efficiency rating for a TOPCon-perovskite tandem product in June, which was a new record for the company. Then in July, LONGi announced news of a commercial-size tandem cell.

“If it’s just us being enthusiastic, that’s one thing. But when there’s 20,000 people working on it worldwide, [from] LONGi, Qcells…I don’t think they’re spending on it because they think it’s daft.”

European innovation

The technological leaps, the market roadmaps and the apparent solutions to degradation all lead to the question of large-scale manufacturing. What role is perovskite going to play in the next phase of the solar industry?

For Ward, innovations in solar technology will be the key to establishing meaningful, long-term manufacturing bases in the global West: “When you look at the debate which took place last year – ‘How do we have a long-term viable, economically profitable PV industry?’ – You can’t do it by just trying to do what everybody else is [already] doing cheaper.”

Indeed, in the last month Chinese PV manufacturers have announced two partnerships to add 30GW of capacity from ingot to module in Saudi Arabia alone, in addition to their vast capacities in China and Southeast Asia. The European Solar PV Industry Alliance has been targeting 30GW of capacity across the value chain by 2025, and is currently unlikely to manage it.

“The only way you do it is to innovate,” Ward says. He then outlines the conditions that could foster a transition from technological innovation to meaningful manufacturing.

“You want to innovate…in a place where there’s respect for intellectual property, where there’s access to skilled human capital because these are technologically advanced products, and where we can have access to [financial] capital to make the investment into high-volume production.”

To Ward, those factors most readily present themselves in the US – unsurprisingly, given its investment into the sector over the last two years – and Germany. The latter has “real desire, real political will to do something. But what does that look like? It’s not subsidising the existing industry, that doesn’t make sense. You’ve got to subsidise something new. It takes longer for that sort of thinking to get alignment and generate support, but we see the will.”

He also cites India and other global destinations where new investments are beginning to take root.

‘Learning curve’

As and when the technology and the market circumstances develop, Oxford PV says it’s in a good position in terms of intellectual property. As already discussed, the company has a strong portfolio of patents going back over a decade, which Ward says puts it ahead of its competitors by a few years.

There are different approaches to putting perovskite-tandem silicon products together, but Ward predicts that “using two terminals and putting the perovskite directly on top of the silicon is broadly going to be the majority of the application. And I do think we have the IP around there.”

“Clearly”, he says, “there are some very big, very successful companies in technology development doing this stuff. But they’ll have to go through that learning curve.”

As with the switch from passivated emitter rear contact (PERC) cells to tunnel oxide passivated contact (TOPCon) cells over the last 18 months, technology changes can spread rapidly through the industry. Ward says that if the company’s bet is right and the next technological step is silicon-perovskite tandems, “It only makes sense for us to get value from that by collaborating with other people.”

The IP that Oxford holds, by Ward’s estimation, then becomes an asset both for the company and the wider industry.

“They’re not our competitors in that regard. [The technology] will flip, and it will flip fast. We can help people go faster, and do it legally.”